On July 27, 2020, the Federal Government passed sweeping legislative changes to its flagship wage subsidy program, the Canada Emergency Wage Subsidy (“CEWS”). While the changes are summarized by the Government on its dedicated website[1], this article reviews many of the changes.

i. Key Changes in the New Legislation

There are seven key amendments to CEWS in the new legislation:

-

-

- CEWS is extended until at least November 21, 2020 (compared to the prior end date of August 29, 2020). The Government has also promised an additional month of funding after that, though the details of that additional funding are still under development.

- Starting August 30, 2020, CEWS funding will begin a gradual reduction process. Funding will thereafter be reduced each month until the program ends in November. This provides a gradual transition off the program instead of the old program’s sudden cliff at the end of August.

- Effective immediately, the amount of funding provided to an employer under CEWS will be based on their actual drop of revenue, scaling up or down to meet the organization’s loss. That means that funding is now tied to need, as opposed to the original one-size-fits-all model. However, until August 29, 2020 (the end of the original program), employers will not receive less under CEWS than they would have under the old rules.

- Effective immediately, employers no longer require at least a 30% decline in revenue to access CEWS. Instead, they can apply for funding that is proportionate to their drop in revenue, even if this decline is less than 30%.

- Starting August 30th, 2020, there will be a split in CEWS for active vs. furloughed employees Furloughed employees (those who are on a paid leave) will have their subsidy aligned with the amounts paid under the Canada Emergency Response Benefit (“CERB”) and employment insurance. That encourages equitable treatment of employees receiving such benefits.

- The new rules provide additional pre-crisis reference points for pre-crisis eligible wages. Starting in claims period #5 (July 5th, 2020 to August 1, 2020), pre-crisis weekly remuneration is based on the average remuneration from January 1, 2020 to March 15, 2020 or from July 1, 2019 to December 31, 2019. The choice can be made on an employee by employee basis.

- Employees will no longer be excluded from CEWS if they do not work 14 or more consecutive days for an employer in an eligibility period. The purpose of this change is to allow easier transition between CEWS and CERB.

-

One thing that continues is the ability of non-profits and charities to choose whether to include or exclude their public funding when calculating their drop in revenue. Keep in mind, however, that the choice an agency makes holds for the rest of the program. An agency cannot flip back to different methods of calculating revenue month to month.

ii. The Details of the New Subsidy Structure

To accomplish many of the goals stated above, the new legislation changes the old 75% flat-rate subsidy into two new scalable subsidy rates. This change is retroactive to July 5th, 2020. However, the new legislation provides companies with no less than they would have received under the old model until August 29th, 2020 (the old end date).

The two new subsidy rates are the “base subsidy”, which is available to all employers, and the “top-up” subsidy that is available to those employers who have seen the largest drop in revenue. An employer can claim both if they are eligible for both.

(a) The Base Subsidy

The base subsidy is the first half of the new combined wage subsidy. The base subsidy is available to any employer with a drop in revenue. It provides a subsidy payment equal to a percentage of the first $1,129.00 per week in wages paid to an employee. The specific percentage that the subsidy is based on scales up or down in proportion to the employer’s drop in revenue.

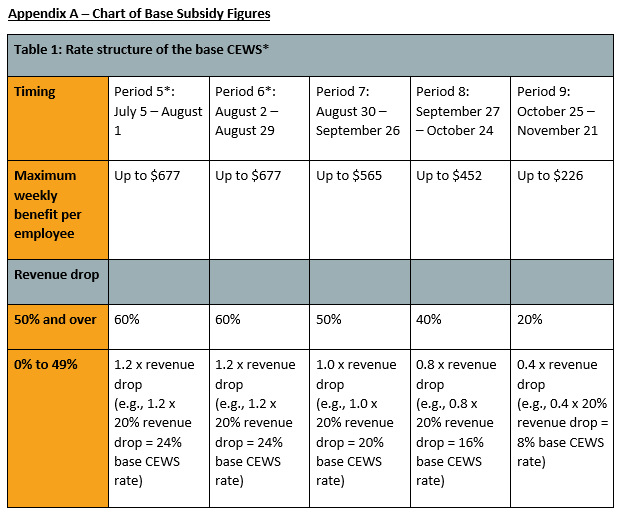

The values and equations that are used to calculate the base subsidy in each month are illustrated in a chart in Appendix A of this article (this chart is reproduced from the Government’s own information page). However, this section also discusses how the base subsidy is calculated in greater detail.

The new legislation provides a formula for calculating the subsidy rate based on revenue drops. The employer will multiply their drop in revenue in that month by a fixed comparison number to determine their base subsidy. In the two claims periods ending on August 29, 2020, the fixed comparison number is 1.2. Calculation of the base subsidy in those two periods would be calculated with the following formula:

Drop in Revenue (%) X 1.2 (the fixed comparison number) = Base Subsidy (%)

For example, a drop in revenue of 25% would be multiplied by 1.2 to get a base subsidy rate of 30%. A 2% drop in revenue would equal 2.4%. Each claim period starting August 30th, 2020 will lower the fixed comparison number in order to produce a smaller subsidy amount. This provides for a gradual reduction in CEWS funding. Again, remember that if an employer would have received more under the old CEWS in claims periods up until August 29th, 2020, they will still receive at least the 75% subsidy rate.

In each month, the Government has set a maximum percentage for the base rate, even if the revenue drop would have entailed a higher percentage but-for the cap. The maximum base subsidy in the two eligibility periods up to August 29, 2020 is 60%. It then winds down to 50% in the next period, 40% in the one after, and then 20% in the last eligibility period from October 25th, 2020 to November 21st, 2020.

As an example, if an employer is entitled to the maximum 60% subsidy, they would receive 60% of the first $1,129.00 they paid their employees per week ($677.00 per employee).

Since the base subsidy is based on the drop in an employer’s revenue, this begs the question of how revenue drops are calculated. Calculating a drop in revenue requires a reference point to compare current revenue to. Similar to the old CEWS, the default reference point for the base subsidy is the employer’s revenue at the same time last year. However, for the 5th claims period (July 5th, 2020 to August 1st, 2020), employers can choose whether to use an alternative reference method going forward: the average revenue of January and February 2020. That alternative choice was previously available to employers when the CEWS program started. Those who previously used the alternative method can also choose to switch back to the default reference method from the 5th claims period-onwards. Whatever choice an employer makes will be their reference method for the rest of the CEWS program.

(b) The Top Up Subsidy

The top up subsidy is the second half of the new CEWS. The top up subsidy provides additional funding of up to 25% of an employee’s wages on top of the base subsidy for employers who have at least a 50% drop in revenue. This helps employers that continue to be hardest hit by the pandemic. Like the base subsidy, the amount of top up subsidy paid will be proportionate to an employer’s drop in revenue.

However, unlike the base subsidy, a different method of calculating revenue drops is used for the top-up subsidy. The default method of calculating revenue drops will be to compare the average monthly revenue of the three months prior to the current claim period against the same three months of the year before. Employers will also have the choice of an alternative comparison method where the prior three months are compared to an average of the revenue from January and February 2020. The choice of comparison method will apply to the employer for the rest of the CEWS program.

A drop of more than 50% revenue using the above reference methods will lead to a phase-in of the top up subsidy. An eligible employer will receive a subsidy equal to 1.25 times the average revenue drop in excess of the 50%, up to a maximum of 25% (reached at a 70% revenue drop). Again, this subsidy rate is applied to the first $1,129 paid to an employee per week.

As an example, say that an employer suffers an average revenue drop of 65%. The revenue drop in excess of 50% is 15%. That 15% is then multiplied by 1.25, which equals a top up subsidy rate of 18.75%. That top up subsidy rate is then added to the base subsidy rate.

iii. CEWS Resources for Employers

The Government of Canada has issued a number of invaluable resources for employers regarding the CEWS.

-

- The Canadian Government has issued an updated version of the CEWS wage subsidy calculator tool.

- The Canadian Government has released a detailed Frequently Asked Questions document on CEWS.

- The Canadian Government has released an application guide for eligible employers.

- The Canadian Government has released a tool tracking use of the CEWS.

As always, PooranLaw will continue to monitor developments related to CEWS and provide updates on our website. In the meantime, if you require legal assistance, we encourage you to reach out to your regular PooranLaw lawyer, or any member of our team.

*Chart reproduced from Government of Canada summary.

** In Periods 5 and 6, employers who would have been better off under the old CEWS design will be eligible for a 75% wage subsidy if they have a revenue decline of 30% or more.

[1] https://www.canada.ca/en/department-finance/news/2020/07/adapting-the-canada-emergency-wage-subsidy-to-protect-jobs-and-promote-growth.html

Note: This article provides general information only and does not constitute, and should not be relied upon as, legal advice or opinion. PooranLaw Professional Corporation holds the copyright to this article and the article and its contents may not be copied or reproduced in any form, in whole or in part, without the express permission of PooranLaw Professional Corporation.